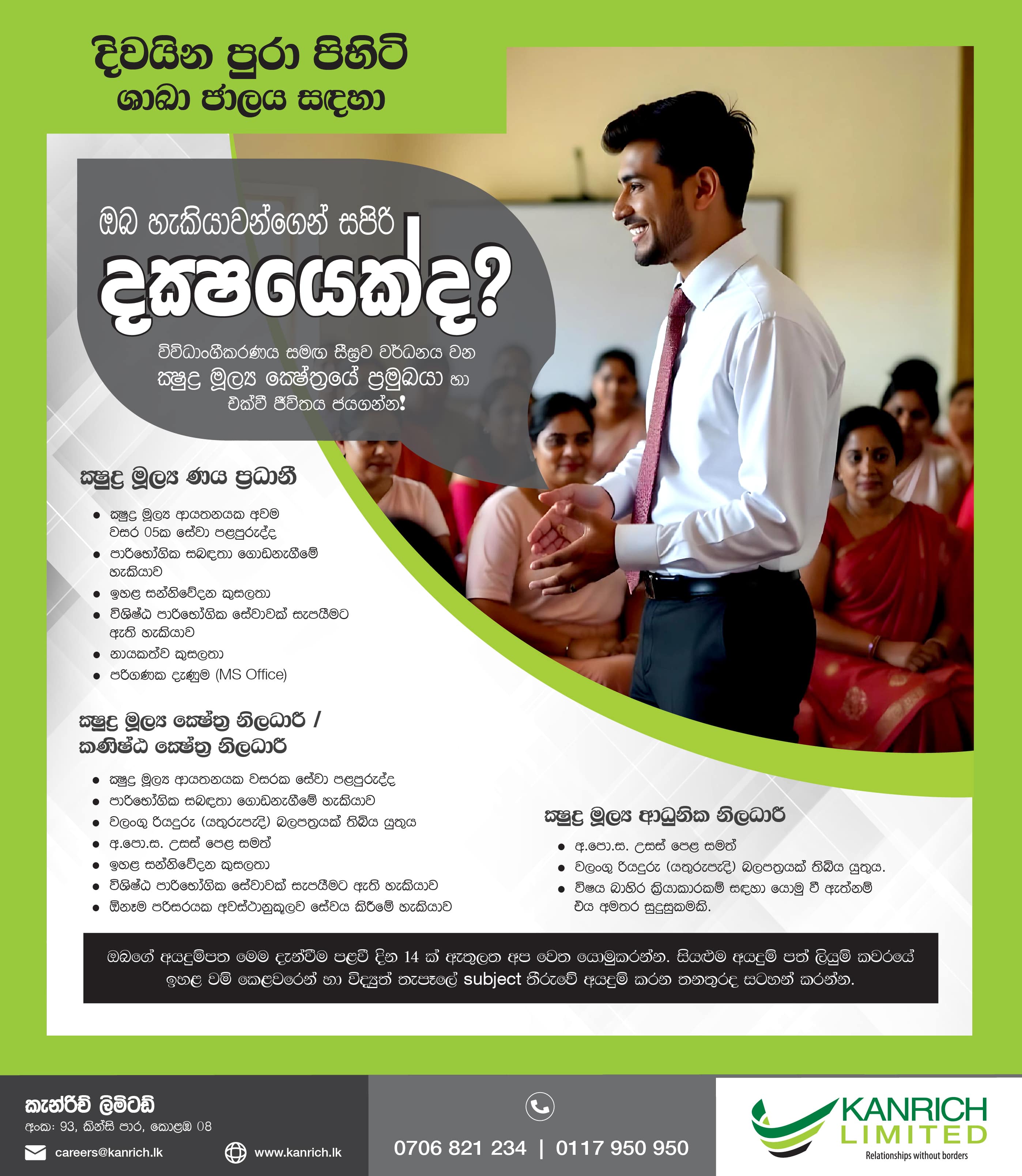

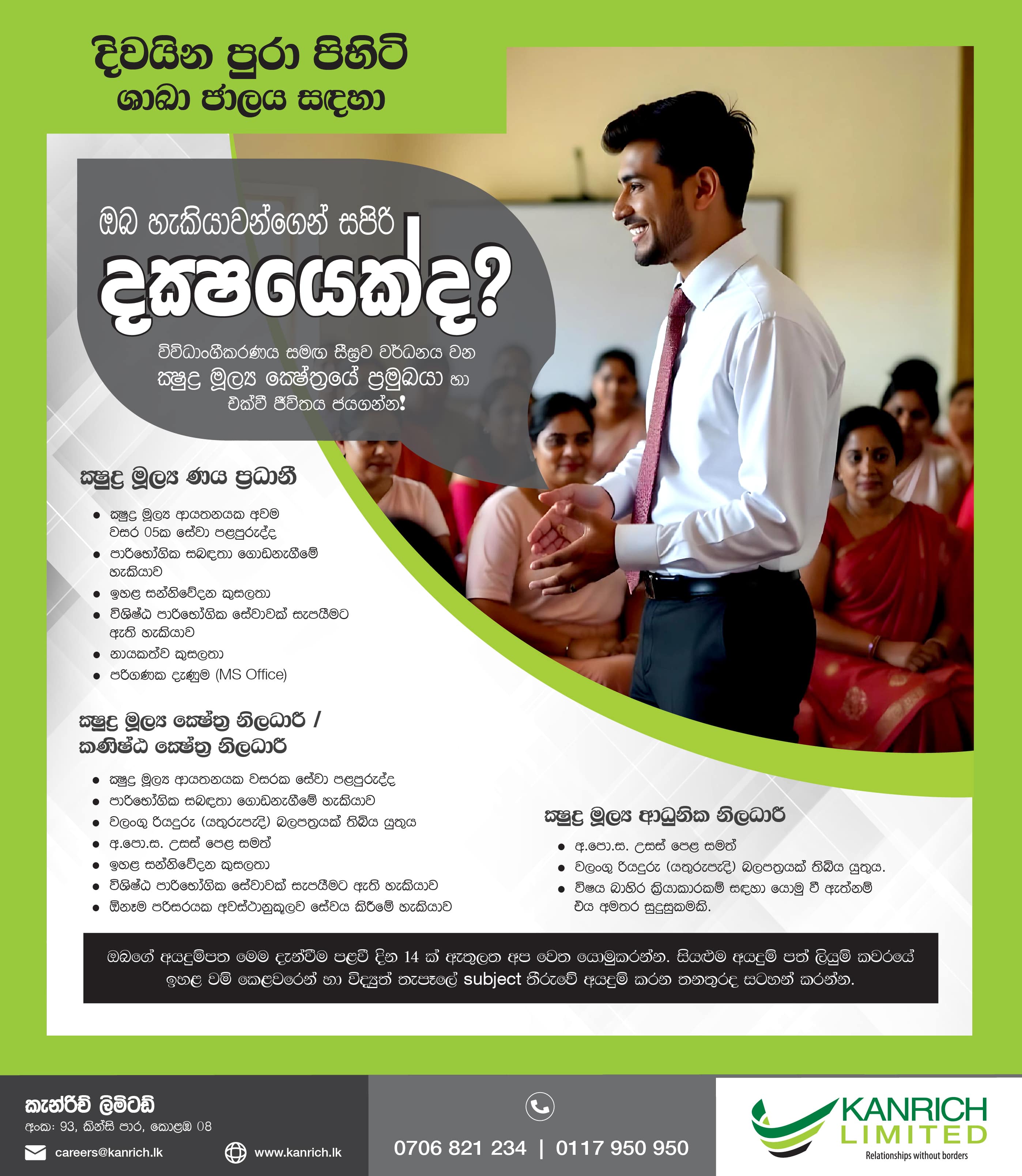

A loan facility, which is available for rural communities to enhance their income and sustainable development. With this product, we support and empower self-employment/ entrepreneurs in agriculture, garment production, arts & crafts industries.

The business model is based on financial inclusiveness, innovations, and customer centric conceptions. The microfinance product aims to provide financial solutions to aforementioned self-employed customers in the fields of agriculture and cottage industries who may not have adequate access to financial instruments to meet their requirements. This scheme focuses largely on rural development.

The business model is based on financial inclusiveness, innovations, and customer centric conceptions. The microfinance product aims to provide financial solutions to aforementioned self-employed customers in the fields of agriculture and cottage industries who may not have adequate access to financial instruments to meet their requirements. This scheme focuses largely on rural development.

The business model is based on financial inclusiveness, innovations, and customer centric conceptions. The microfinance product aims to provide financial solutions to aforementioned self-employed customers in the fields of agriculture and cottage industries who may not have adequate access to financial instruments to meet their requirements. This scheme focuses largely on rural development.

The business model is based on financial inclusiveness, innovations, and customer centric conceptions. The microfinance product aims to provide financial solutions to aforementioned self-employed customers in the fields of agriculture and cottage industries who may not have adequate access to financial instruments to meet their requirements. This scheme focuses largely on rural development.